UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)Section14(a) of the Securities Exchange Act of 1934

(Amendment No. ) | | | | | |

| x | Filed by the Registrant |

| o | Filed by a Party other than the Registrant |

| | | | | |

| CHECK THE APPROPRIATE BOX: |

| o | Preliminary Proxy Statement |

| o | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Under Rule 14a-12 |

MULTIPLAN CORPORATION

| | |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| | | | | |

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1)Title of each class of securities to which transaction applies: |

| 2)Aggregate number of securities to which transaction applies: |

| 3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4)Proposed maximum aggregate value of transaction: |

| 5)Total fee paid: |

| o | Fee paid previously with preliminary materials: |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| 1)Amount previously paid: |

| 2)Form, Schedule or Registration Statement No.: |

| 3)Filing Party: |

| 4)Date Filed: |

Notice of StockholderAnnual Meeting of

Stockholders and Proxy Statement

MultiPlan

MultiPlan is a leading provider of data analytics and technology-enabled solutions designedcommitted to bringdelivering affordability, efficiency, and fairness to the U.S.US healthcare industry. Our services reduce medicalsystem by helping healthcare payors manage the cost of care, improve their competitiveness, and improve billinginspire positive change. Leveraging sophisticated technology, data analytics, and a team rich with industry experience, MultiPlan interprets customers’ needs and customizes innovative solutions that combine its payment accuracy forand revenue integrity, network-based and analytics-based, and data and decision science services. MultiPlan is a trusted partner to over 700 healthcare payors, brokers, employer groups, and supplemental carriers in the payors of healthcare, which arecommercial health, insurers, self-insured employersgovernment, and other health plan sponsors (typically through their health plan administrators),property and indirectly, the plan members who are the consumers of healthcare services.casualty markets.

For more information, visit multiplan.com.

Message from our President and Chief Executive OfficerChair of the Board

| | | | | |

Dear Stockholders, We would likeIt is our pleasure to invite you to attend a meetingour Annual Meeting of stockholdersStockholders (the “Stockholder“Annual Meeting”) at 9:00 a.m., Eastern Time, on Friday, August 4, 2023.Wednesday, April 24, 2024. Holders of record of our Class A common stock as of the close of business on July 6, 2023March 1, 2024 are entitled to notice of, and to vote at, the StockholderAnnual Meeting. In order to enable participation by a broader number of stockholders, we will again conduct our StockholderAnnual Meeting virtually at www.virtualshareholdermeeting.com/MPLN2023SM.MPLN2024.

AtThe year 2023 was a pivotal one for MultiPlan. We began the Stockholders Meeting you will be askedyear with a new Growth Plan in hand and clear sense of what we needed to (1) elect four Class II directors to hold office untilaccomplish. Throughout the 2025 annual meeting of stockholders and four Class III directors to hold office until the 2026 annual meeting of stockholders, (2) approve the adoptioncourse of the year, we worked hard to execute on that Plan. Among other initiatives, we launched new products to enhance our core services, we made an exciting acquisition to accelerate the development of our new Data and Decision Science service line, and we continued to make progress on improving our capital structure. We believe these actions have set us firmly on a path to transform our business over the next several years.

Amid all this progress, MultiPlan Corporation 2023 Employee Stock Purchase Plan (the “ESPP”)remained steadfast in its mission to reduce healthcare costs while delivering affordability, efficiency, and (3) transact any other business as properly may come beforefairness to the Stockholders Meeting or any adjournment or postponement thereof. Each of the Class II directors nominated by our Board of Directors were previously submittedmore than 100,000 employers and estimated 60 million consumers that had access to our stockholdersservices through our customers. For these stakeholders, we processed $168.6 billion of medical charges, identified over $22.9 billion of potential medical cost savings and helped lower out-of-pocket costs and reduce or eliminate millions of balance bills for election at the annual meeting of stockholders held by MultiPlan on April 26, 2022 (the “2022 Meeting”). Each of the Class III directors nominated by our Board of Directors and the ESPP were previously submitted to our stockholders at the annual meeting of stockholders held by MultiPlan on April 26, 2023 (the “April 2023 Meeting”). All of the nominated directors are currently serving as a member of the Board of Directors and have done so continuously since prior to the 2022 Meeting.

On May 31, 2023, a purported stockholder of MultiPlan filed a complaint in the Court of Chancery of the State of Delaware alleging that the record dates used for the 2022 Meeting and the April 2023 Meeting violated Section 213(a) of the Delaware General Corporation Law, as amended (the “DGCL”), because they were each 61 days prior to the date of the applicable annual meeting of stockholders and Section 213(a) of the DGCL requires that the record date not be more than 60 days prior to the date of the meeting. Our Board of Directors has determined that it is in the best interests of the corporation and its stockholders to re-submit Proposals No. 1 and 2 to a vote of our stockholders at the Stockholder Meeting in order to remedy any technical defects under the DGCL related to matters voted on at the 2022 Meeting and the April 2023 Meeting.

The Stockholder Meeting shall constitute the Company’s 2023 annual meeting of stockholders for the purposes of the DGCL.healthcare consumers.

I would like to thank our stockholders for your continued support and confidence in MultiPlan. I would also like to acknowledge our more than 2,5002,800 outstanding MultiPlan colleagues, whose talent, expertise, and dedication make achieving our mission possible. Dale A. White

| Dale White

President and Chief Executive Officer |

MULTIPLAN’S MISSION "We remain focused on our vision to promote affordability, efficiency, and fairness in healthcare and are proud of the critical role we play in generating medical cost savings for stakeholders in the U.S. healthcare ecosystem."

|

|

| | | | | |

20232024 Proxy Statement | 1 |

Notice of StockholderAnnual Meeting of Stockholders

Background

| | | | | | | | |

| | |

| | |

| DATE AND TIME | LOCATION | WHO CAN VOTE |

Friday, August 4, 2023Wednesday, April 24, 2024

at 9:00 a.m. EDT | Online only at: www.virtualshareholdermeeting.com/MPLN2023SMMPLN2024 | The record date for determining stockholdersStockholders entitled to receive notice of and to vote at the StockholderAnnual Meeting is July 6, 2023*March 1, 2024* |

*A list of these stockholders will be open for examination by any stockholder for any purpose germane to the Stockholder2024 Annual Meeting for a period of 10 days prior to the Stockholder2024 Annual Meeting at 115 5th Ave., New York, NY 10003. In addition, this list will be available electronically during the Stockholder2024 Annual Meeting at www.virtualshareholdermeeting.com/MPLN2023SM.MPLN2024.

Voting Items

| | | | | | | | |

| | Board

Recommendation |

| Proposal 1: | Election of the four Class II and four Class IIII nominees named in this proxy statement to our Board of Directors |  FOR each director nominee FOR each director nominee |

| Proposal 2: | Ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2024 |  FOR FOR |

| Proposal 3: | Advisory vote to approve the compensation of our named executive officers |  FOR FOR |

| Proposal 4: | Approval of the Amendment to the MultiPlan Corporation 2023 Employee Stock Purchase2020 Omnibus Incentive Plan |  FOR FOR |

Stockholders will also transact such other business as may properly come before the StockholderAnnual Meeting or any adjournment thereof.

Advance Voting Methods

| | | | | | | | |

| | |

| | |

| TELEPHONE | INTERNET | MAIL |

| 1-800-690-6903 | www.proxyvote.com | Vote Processing, c/o Broadridge,

51 Mercedes Way, Edgewood, New York 11717 |

Jeffrey A. Doctoroff

Corporate Secretary

This proxy statement and accompanying proxy card are first being made available on or about July 10, 2023.March 13, 2024.

| | |

|

Whether or not you expect to virtually attend the Stockholder Meeting,annual meeting, please submit your proxy as soon as possible. If you do virtually attend the Stockholder Meeting,annual meeting, you may revoke your proxy and vote in person. Most stockholders have three options for submitting their proxies prior to the Stockholder Meeting:annual meeting: (1) via the internet, (2) by phone, or (3) by signing and returning the enclosed proxy. If you have internet access, we encourage you to appoint your proxy on the internet. It is convenient, and it saves the company significant postage and processing costs. |

Table of Contents

| | | | | |

20232024 Proxy Statement | 3 |

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Amendment to MultiPlan Corporation 2020 Omnibus Incentive Plan |

| |

PROPOSAL 2: 4: Approval of the Amendment to MultiPlan Corporation 2023 Employee Stock Purchase2020 Omnibus Incentive Plan | |

| |

| |

| |

| |

| |

| |

|

| |

|

| |

| |

| |

| |

| |

| |

| |

About MultiPlan

The Value We Create

Business and Background

MultiPlan Corporation (“MultiPlan” or the “Company”) is a market leading provider of data analytics and technology-enabled solutions designed to bring affordability, efficiency and fairness to the U.S. healthcare industry. We do so throughThrough our proprietary data and technology platform, we provide out-of-network cost management, payment and revenue integrity, data and decision science, business-to-business ("B2B") healthcare payments and other services focused on reducing medical costs and improving billing and payment accuracy forto the payors of healthcare, which are health insurers and their administrative-services-only ("ASO") platforms, self-insured employers, federal and state government-sponsored health plans (collectively, “Payors”) and other health plan sponsors (typically through their health plan administrators), and, indirectly, the plan members who are the consumers of healthcare services.

MultiPlan was founded in 1980 as a New York-based hospital network and leveraged its position to pursue a consolidation strategy that established the Company as a leading independent national preferred provider organization ("PPO"). During that time, the Company invested significant capital in our data and technology assets to become a leading independent provider of out-of-network cost management and in- and out-of-network billing and payment accuracy services. These investments have created a data and technology platform that has evolved both organicallyenabled the Company to pursue a strategy of developing or acquiring new product and through acquisition intoservice offerings and swiftly and efficiently bringing them to scale.

MultiPlan's platform sits at the nexus of four principal stakeholders in the healthcare industry – Payors, employers/plan sponsors, plan members and healthcare providers. Our platform is uniquely positioned as a national organization offeringprovider of independent solutions that reduce healthcare costs in a suitemanner that is fair to all these stakeholders.

Although the end beneficiaries of our services that efficiently addressare employers and other plan sponsors and their health plan members, our direct customers are typically Payors, including ASOs and third-party administrators ("TPAs"), who go to market with our services to those end customers. Our platform offers these Payors a single interface to our services, which are used in combination or individually to reduce the medical cost burden on their health plan customers and members, by managing the utilization of medical services, lowering the per-unit cost of medical services. services incurred, and ensuring the services are reimbursed without error and accepted by the provider.

MultiPlan offers servicessolutions to our customers in three categories:across four service categories from our platform:

•Analytics-Based Services: a suite of data-driven algorithms and insights that detect claims over-charges and either negotiate, or recommend fair reimbursement for, out-of-network medical costs using a variety of data sources and pricing algorithms. These services are applied prior to the payment of the claim and are often processed within a day of receipt;receipt. Also included in this category is our Value-Driven-Health Plan services, which bundles reference-based pricing and member and provider engagement tools, enabling employers and other health plan sponsors to offer low-cost health plans;

•Network-Based Services: contracted discounts with healthcare providers to form one of the largest independent preferred provider organizations (“PPO”) in the United States as well as outsourced network development and/or network management services. These services are applied prior to the payment of the claim and are typically processed within a day of receipt; and,

•Payment and Revenue Integrity Services: data, technology, and clinical expertise deployed to identify and remove improper and unnecessary charges before or after claims are paid, or to identify and help restore and preserve underpaid premium dollars.dollars; and

MultiPlan sits at the nexus of four constituencies – Payors, employers/plan sponsors, plan members•Data and providers – offering an independent reimbursement solution to reduce healthcare costs in a manner that is systematic, efficient and fair to all parties involved. Although the end beneficiary of our services are employers and other plan sponsors and their health plan members, our direct customers are typically health plan administrators who go to market with our services. Over the last 40+ years, we have developed a platform that offers these Payors a single interface to a comprehensive set of services, which are used in combination or individually to reduce the medical cost burden on their health plan customers and members while fostering independently developed fair and efficient reimbursements to healthcare providers.

Decision Science Services:

Our comprehensive service offerings are often utilized as a suite of solutions that apply modern methods and data science to manage medical costsproduce descriptive, predictive, and prescriptive analytics that drive optimized benefit plan design, support decision-making, improve clinical outcomes, and reduce the total cost of care. We formed this newer service category in 2023 and accelerated its development through the acquisition of Benefits Science LLC ("BST").

Additionally, in 2023 MultiPlan entered into a joint marketing and services agreement with ECHO Health, Inc. ("ECHO") that adds payment processing of healthcare provider claims as well as payments made to other service providers. We believe our B2B payments offering has the potential to enhance the value we provide across each of our primary service categories.

The breadth of our service offerings allows our customers the flexibility to tailor solutions for a wide range of plan sponsors with varying plan sizes and benefit needs. At the same time, our service offerings are delivered from our common platform and are often embedded intobundled together to provide a comprehensive cost management solution for our customers’ technology environments, enabling us to maintain long-term relationships withcustomers. As such, we manage our service offerings as integrated components of a number of our customers, including relationships of over 25 years with some of the nation’s largest Payors. For the year ended December 31, 2022, our services identified approximately $22.3 billion in potential medical cost savings in $155.2 billion of medical claim charges processed.

Unless otherwise noted, “we,” “us,” and “our” refer to MultiPlan and its consolidated subsidiaries.

Our principal executive office is located at 115 Fifth Avenue, New York, New York, 10003.

We Make Healthcare More Affordable, Efficient, and Fair

| | | | | |

| We help address the estimated $1.2 trillion, about a thirdas much as 30% of U.S. healthcare spend, that is attributed to waste or abuse that leads to overcharges |

| Our services provide an independent means of adjudicating fair reimbursement between the providers of health services and the Payors, plan sponsors and members who access those services |

| In 2022,2023, we helped our Payor customers serve more than 60 million plan members and over 100,000 employers/plan sponsors |

| MultiPlan services identified $22.3$22.9 billion in potential medical cost savings for our customers, their health plan customerssponsors and members on $155.2$168.6 billion claims processed in 2022 alone2023 and helped reduce or eliminate millions of balance bills for healthcare consumers |

Our Competitive Advantages

We believe MultiPlan is uniquely positioned by the competitive advantages we have cultivated and continue to develop. These advantages consistIn support of a platform of differentiated resources that are difficult to replicate, as well as dynamic capabilities that enable us to quickly reconfigure our resources to address our customers’ evolving needs and to capture new opportunities in the market.

The unique resources and capabilities on our platform include:

| | | | | |

| Distinct Knowledge and ExperienceAcquired from servicing over 700 Payors and data from over 40+ years

|

| Connected Nationwide network of over 1.3M contracted providers developed over the course of 40+ years

|

| Differentiated technology platformProprietary pricing methodologies enhanced by access to over one billion medical claims produce high throughput processing allowing approximately99% same day turnaround

|

| Operational excellence and scale Deep domain expertise, extensive customer connectivity, and customizable solutions supported by100+ network developers,400+ negotiators, and a team of1,000+ operations and500+ IT associates that drive service delivery

|

| Independent Standard High levels of provider acceptance, based on rigor, transparency, independence, and a track record of producing fair and efficient reimbursements

|

MultiPlan’s Growth Strategy

In meeting our mission to drive fairness,affordability, efficiency and affordabilityfairness for U.S. healthcare, MultiPlan has historically focused on helping Payors manage medical spend by lowering per-unit claim costs and improving billing and payment accuracy. Our growth strategy seeksThe evolutionary path we have taken and the significant investments we have made to amplifyrealize this value proposition,ambition have provided MultiPlan with distinctive assets that allow us to more holistically help Payors address the growing cost, risk and expand beyond it, by leveragingcomplexity of healthcare across both commercial and government markets. Above all, these distinctive assets include strong relationships with our longstanding customer relationshipscustomers and extensivea proprietary data and algorithms. The strategy has three components:technology platform. These assets are comprised of difficult to replicate resources that have competitively differentiated attributes:

| | | | | |

| Leading Position with Healthcare Payors We have cultivated over 700 payor relationships over 40+ years, and we strategically engage with our customers, resulting in extensive proprietary data, deep domain expertise, differentiated customer knowledge, and a large distribution channel for scaling new products and service offerings |

| Connected and Deeply Integrated Our platform is deeply integrated with many of our customers' information technology environments in a highly customized manner and occupies a differentiated position in our customers' workflow by accessing and processing claims prior to payment of those claims to providers ("pre-payment") |

| Operational Excellence and Scale Our platform processes significant transactions volumes and can add products or volume without large incremental investments in infrastructure or people. This allows us to produce valuable services at lower unit costs than competitors and make significant investments in these services on behalf of our customers |

| Unique Products, Services and Capabilities Our platform consists of a very broad suite of solutions, a nationwide network of over 1.4 million contracted providers, patented claim pricing methodologies, over 400 expert claims negotiators, and next generation data and decision science. We dynamically reconfigure, build, and integrate internal and external resources and competencies, to respond to evolving customer needs and new market opportunities |

MultiPlan’s Growth Strategy

MultiPlan has developed distinctive assets that include longstanding, strategic relationships with our customers and a proprietary data and technology platform that is deeply integrated with many of our customers' information technology environments in a highly customized manner and that occupies a unique position in our customers' workflow by accessing and processing claims prior to payment of those claims to providers ("pre-payment"). The cornerstone of our growth strategy is leveraging these distinctive assets to introduce and efficiently scale new products and service offerings to deliver more value to customers in our core and adjacent markets and to drive growth in our revenues and profits.

The Company has identified and prioritized a set of growth initiatives aimed at capitalizing on the value of our distinctive assets and platform. These growth initiatives include:

| | | | | |

| Transforming into a product-centric organizationand developing a deep pipeline of new products to be launched over the next several years |

| Enhancing existing service performancecore services through technology, data,to bolster our competitive advantage and strategic changes aimed at delivering more value on thegenerate additional savings, by new products and product enhancements to our core out-of-network claim volume we already receive from existing customerspricing and payment and revenue integrity solutions as well as solidifying our leadership position in NSA services |

| Adding servicesExpanding our Value-Driven Health Plans ("VDHP" or evolving existing service features"HST") platform to advance our objective of delivering a turnkey health plan solution for employer plan sponsors ("Employer Solution in a Box") and functions withinexpand our core service offerings, with initiatives informed by continuously scanningpresence in the marketTPA and the unique insights our customers share into the market’s unmet needs and changing preferencesdirect to employer channels

|

| Introducing new services, either organically or via acquisition, that deliver different value propositions to our customers. Our recent focus in this area has been on growingthe addition of the Data and Decision Science Services line that adds a suite of descriptive, predictive, and prescriptive analytics products that enable us to monetize our footprint with in-network commercial claims flows and Medicare Advantage claims, which significantly increasesincrease our total addressable market while leveraging our deep existing customer relationships and existing technology infrastructurefootprint in government markets |

During 2023, we made tangible progress on each of our growth initiatives. We named a Senior Vice President of Product and increased staffing of our product development team. In our core services, we introduced our Pro Pricer™ product, which leverages machine learning technology to dynamically route claims to our various repricing solutions to improve pricing recommendations, and we introduced functionality enhancements to our itemized bill review service, including the capability to use prepayment integrity analytics to mine claim data and prioritize the adjudication of high-dollar, multi-item inpatient facilities claims. We introduced our Balance Bill Protection™ product, enabling customers of our VDHP (HST) platform to take advantage of our reference-based pricing solution while ensuring full provider acceptance and alleviating abrasion between plan members, employers and providers. We formed our Data and Decision Science Services line and subsequently added a suite of data and decision science products through our acquisition of BST. We also added a B2B healthcare payments service through a joint marketing and services agreement with ECHO Health, to enhance the value we provide and our competitive position in certain targeted customer channels, including the third-party administrator and regional health plan channels.

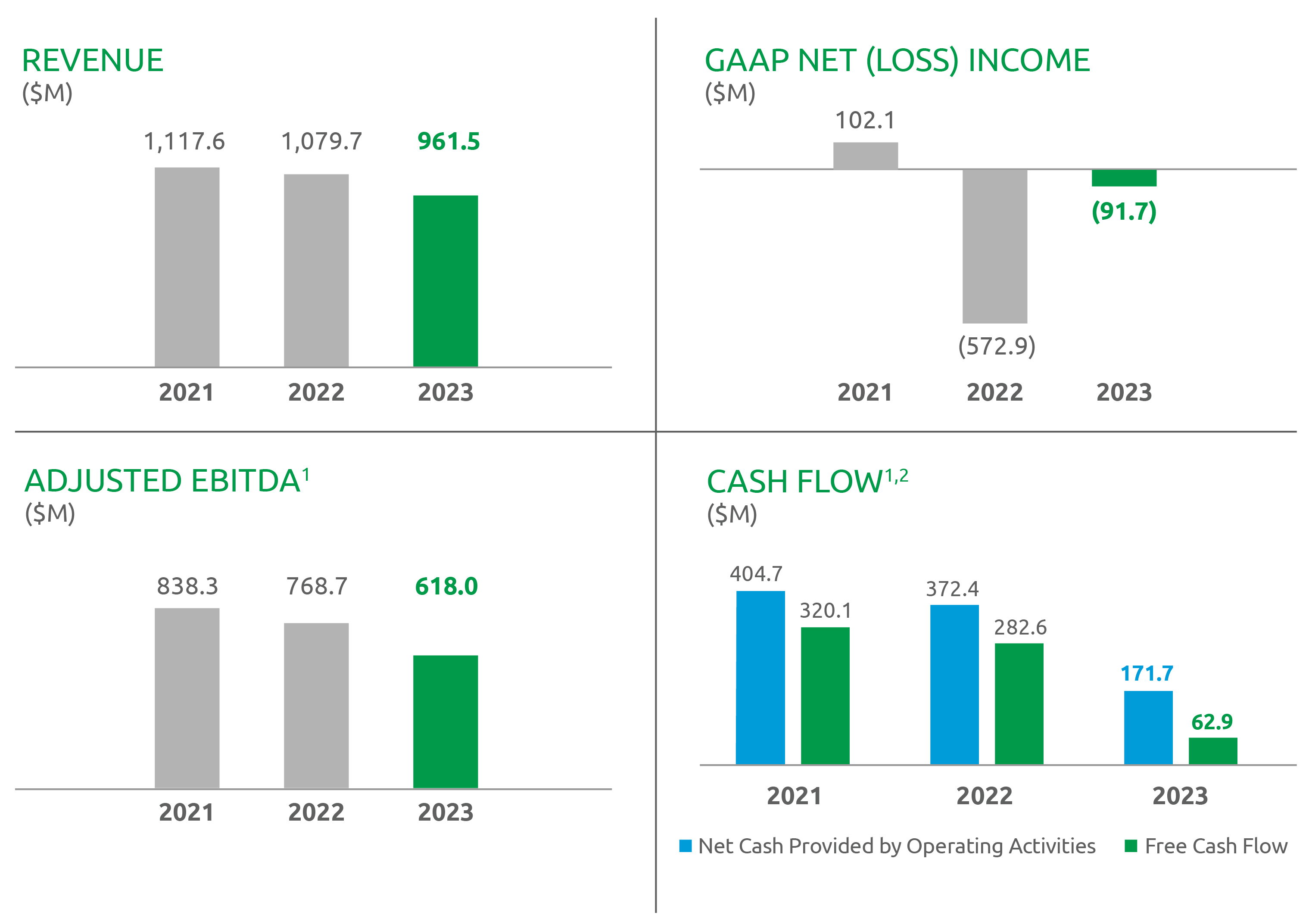

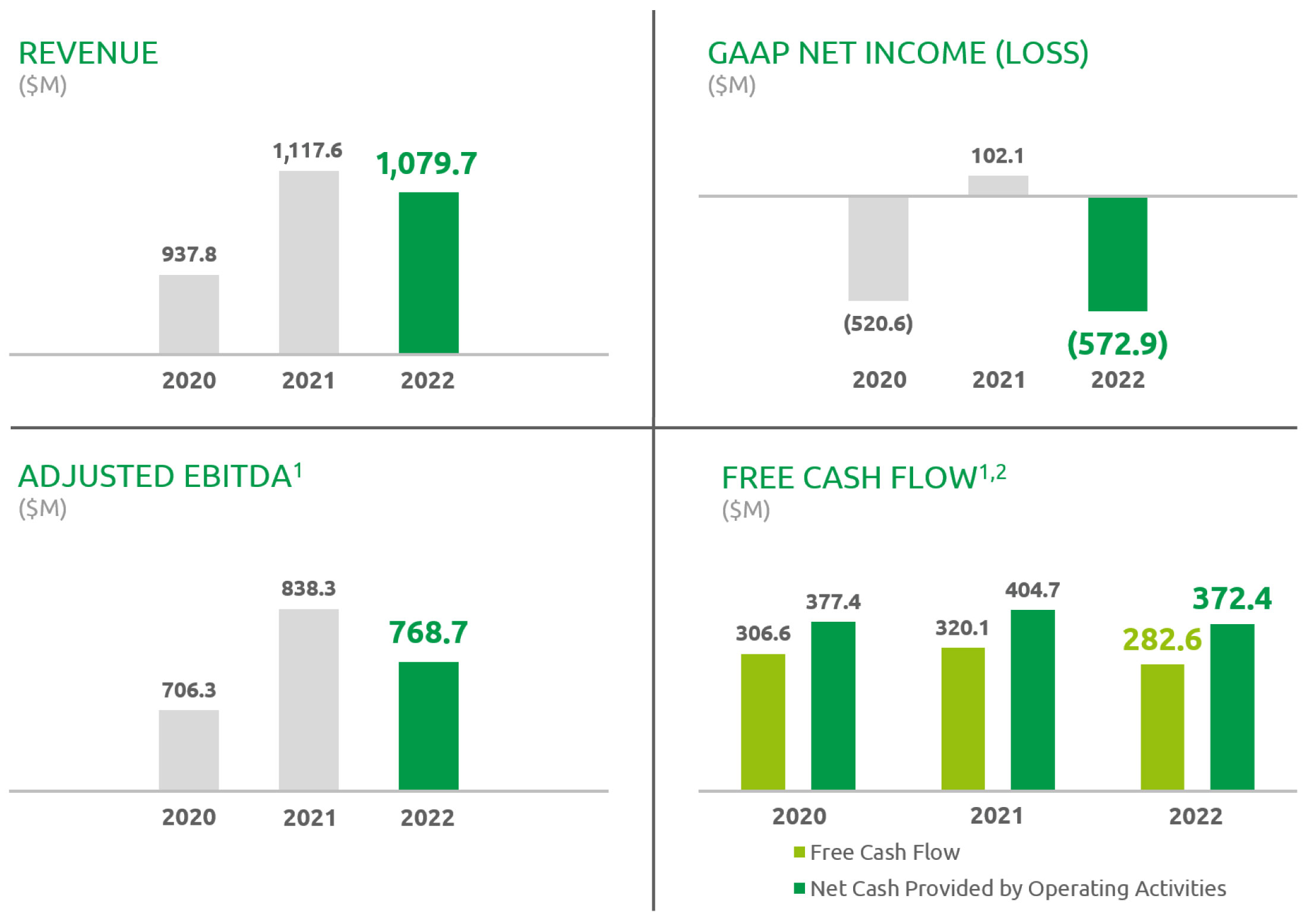

Financial Highlights

We began 2023 with a vision for transforming our business, including a new Growth Plan. Throughout the year, we executed and advanced each of the growth initiatives under the Plan, launching new products to enhance our core services and establishing a new Data and Decision Science service line that was accelerated by the acquisition of Benefits Science LLC ("BST"). We also continued to deliverbe active and disciplined with capital allocation and made meaningful progress toward reducing our debt in 2023 by repurchasing and repaying approximately $222 million of face value of our debt.

Amid the progress we made toward the transformation of our business, in 2023 we remained focused on delivering strong financial results in 2022. Amid challengesperformance. Although our revenue declined year-over-year, the visibility and stability of our revenue increased following the contract renewals with our larger customers at the beginning of 2023, and our business began to grow again in the external environment, including high levelssecond half of inflation that suppressed utilization of healthcare services, we achieved several important milestones during the year. Among these,We also focused on containing our costs and maintaining best-in-class margins. As a result, we successfully implementedwere able to meet our new No Surprises Act (“NSA”) services to help our customers navigate the complexities of complying with the NSA,revenue and we signed multi-year contract extensions with two of our larger customers. Moreover, we processed a record $155.2 billion in medical chargesAdjusted EBITDA expectations for 2023 and identified $22.3 billion of potential medical cost savings for stakeholders in the U.S. healthcare system. generate positive cash flow.

Below are key metrics regarding our 20222023 financial performance.

(1)See reconciliation of non-GAAP measures in “Use of Non-GAAP Measures” in this proxy statement

(2)Free Cash Flow is defined as net cash provided by operating activities less capital expenditures

Proxy Voting Roadmap

| | | | | | | | | | | | | | |

| | | | |

| PROPOSAL 1 | | |

| ELECTION OF DIRECTORS | | |

| | | | |

| | | | |

| | THE BOARD RECOMMENDS A VOTE FOR EACH OF THE CLASS II AND CLASS IIII DIRECTOR NOMINEES | | |

| | | | |

CLASS III DIRECTOR NOMINEES | | | | | | | | | | | | | | | | | | | | |

|

|

| | | | | | | | | | | | | | | | | | Committees |

| Name and Principal Profession | Age | Independent | Audit | Compensation | Nominating & Corporate Governance | Risk |

Michael K. Attal Principal, Hellman & Friedman LLC | 31 | | Observer |

|

| |

Travis S. Dalton President and Chief Executive Officer, MultiPlan Corporation | 53 | | | | | |

C. Martin Harris AVP of the Health Enterprise and Chief Business Officer, Dell Medical School at the University of Texas at Austin | 67 | |

|

|

| |

John M. Prince Former President and COO of Optum | 56 | | |

|

| |

| | | | | | |

| CONTINUING DIRECTORS |

|

|

|

|

| |

|

|

| Committees |

| Name and Principal Profession | Age | Independent | Audit | Compensation | Nominating & Corporate Governance | Risk |

Glenn R. August Founder and Chief Executive Officer, Oak Hill Advisors | 62 | |

|

| | |

Richard A. Clarke Chief Executive Officer, Good Harbor Security Risk Management | 7273 | | | |

| C |

Anthony Colaluca, Jr. President, Colaluca Business Advisors LLC | 57 | | C | |

| | C

Julie D. Klapstein Former Chief Executive Officer, Availity, LLC | 6869 | | | |

| |

P. Hunter Philbrick

Partner, Hellman & Friedman LLC

| 43 | |

| C | | |

| | | | | | |

CLASS III DIRECTOR NOMINEES | | | | | |

|

|

| Committees |

Name and Principal Profession | Age | Independent | Audit | Compensation | Nominating &

Corporate Governance

| Risk |

Anthony Colaluca, Jr.

President, AfterNext HealthTech Acquisition Corp.

| 56 | | C | |

| |

Michael S. Klein Founder and Managing Partner, M. Klein and Company, LLC | 5960 | |

|

|

| |

P. Hunter Philbrick Partner, Hellman & Friedman LLC | 44 | |

| C | | |

Allen R. Thorpe Partner, Hellman & Friedman LLC | 5253 | Lead Director |

|

| C | |

Dale A. White President and Chief Executive Officer,Chair, MultiPlan Corporation

| 6768 | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| CONTINUING DIRECTORS

|

|

|

|

| |

|

|

| Committees |

Name and Principal Profession | Age | Independent | Audit | Compensation | Nominating &

Corporate Governance

| Risk |

Michael K. Attal

Principal, Hellman & Friedman LLC

| 31 | | Observer |

|

| |

C. Martin Harris

AVP of the Health Enterprise and Chief Business Officer, Dell Medical School at the University of Texas at Austin

| 66 | |

|

|

| |

John M. Prince

Former President and Chief Operating Officer, Optum

| 56 | | | | | |

Mark H. Tabak

Non-Executive Chairperson of the Board, MultiPlan Corporation

| 73 |

| |

|

| |

| | |

|

CORPORATE GOVERNANCE HIGHLIGHTS •75%77% of members the Board are independent in accordance with Section 303A.02 of the New York Stock Exchange (“NYSE”) Listed Company Manual;Manual. This independence percentage will increase to 83% following the Annual Meeting. The Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee are also independent pursuant to applicable NYSE requirements. •Directors are required to retire from the Board when they reach the age of 75; in addition, the Board will not nominate for re-election any non-executive director if he or she has completed 15 years of service as a director. •The Board includes a diversity of experience, background, gender, age and race to ensure that a broad range of views are considered. •The Board has appointed a lead independent director, who is integrally involved in establishing and leading the Board agenda and interacting with management on a regular basisbasis. |

|

| | | | | | | | | | | | | | |

| | | | |

| PROPOSAL 2 | | |

| APPROVALRATIFICATION OF THE MULTIPLAN CORPORATION 2023 EMPLOYEE STOCK PURCHASE PLANINDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | |

| | | |

| | | |

| | THE BOARD RECOMMENDS A VOTE FOR THIS PROPOSAL | | |

| | | | |

| | | | | | | | | | | | | | |

| | | | |

| PROPOSAL 3 | | |

| ADVISORY VOTE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | | |

| | | |

| | | |

| | THE BOARD RECOMMENDS A VOTE FOR THIS PROPOSAL | | |

| | | | |

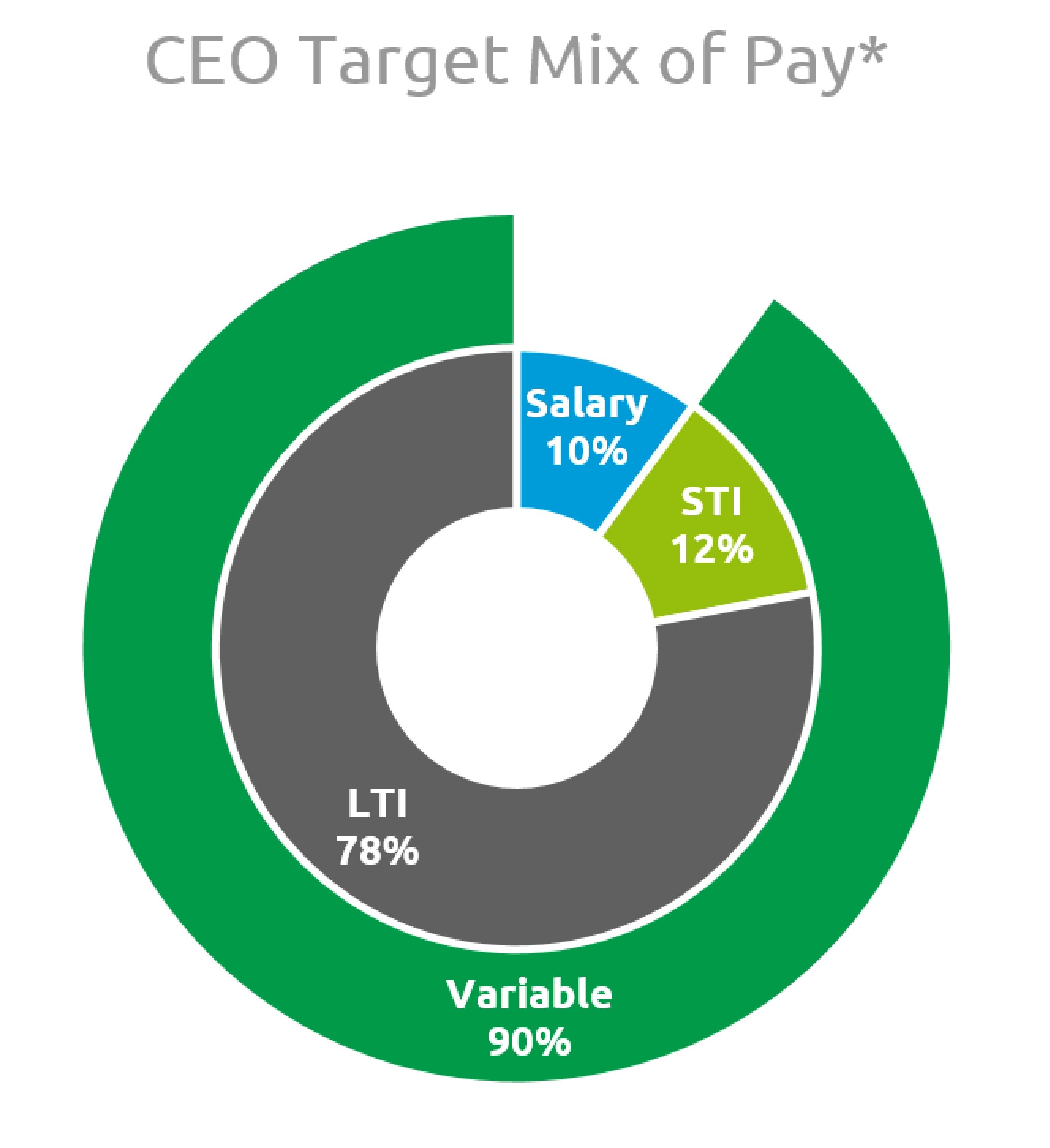

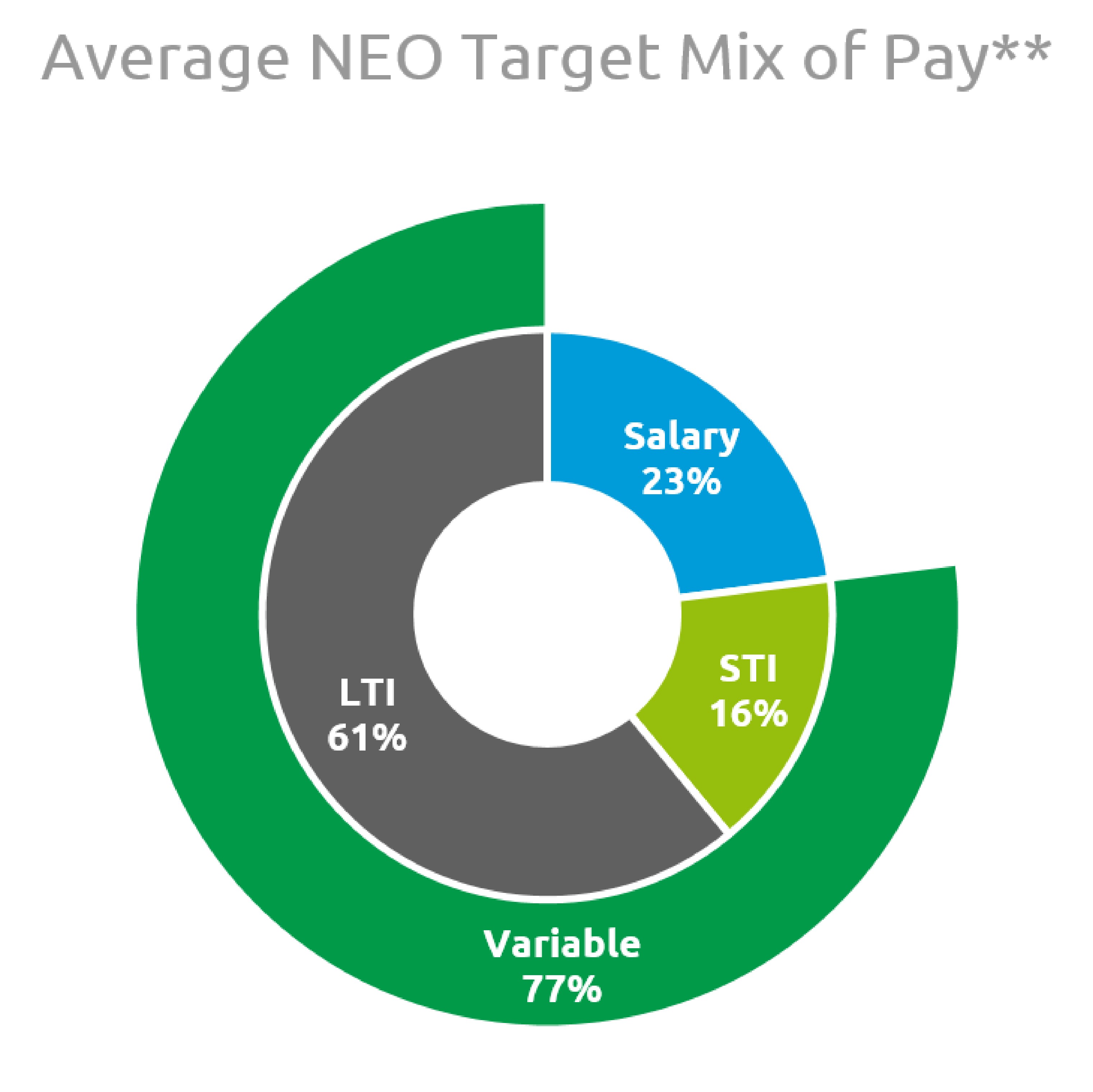

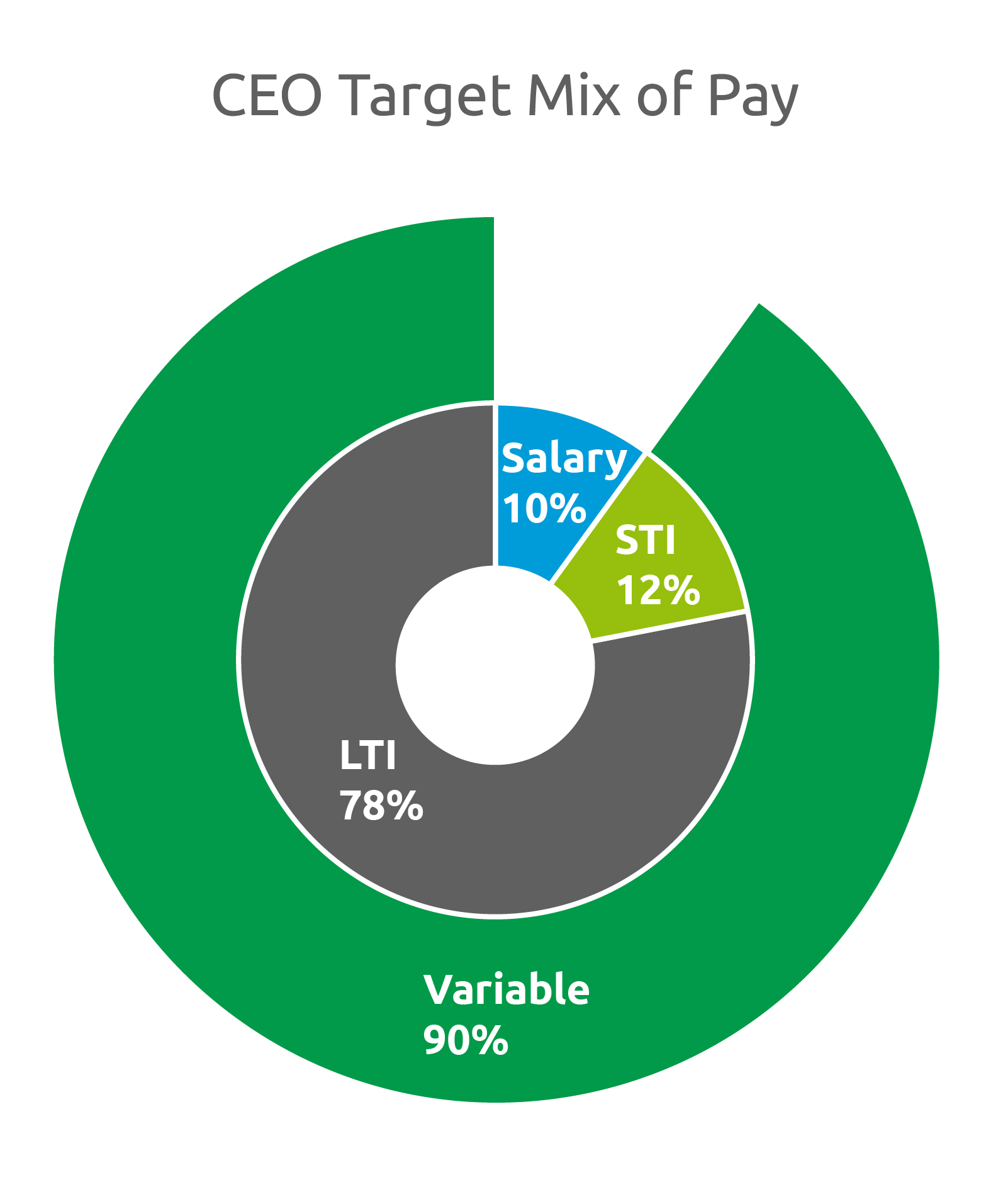

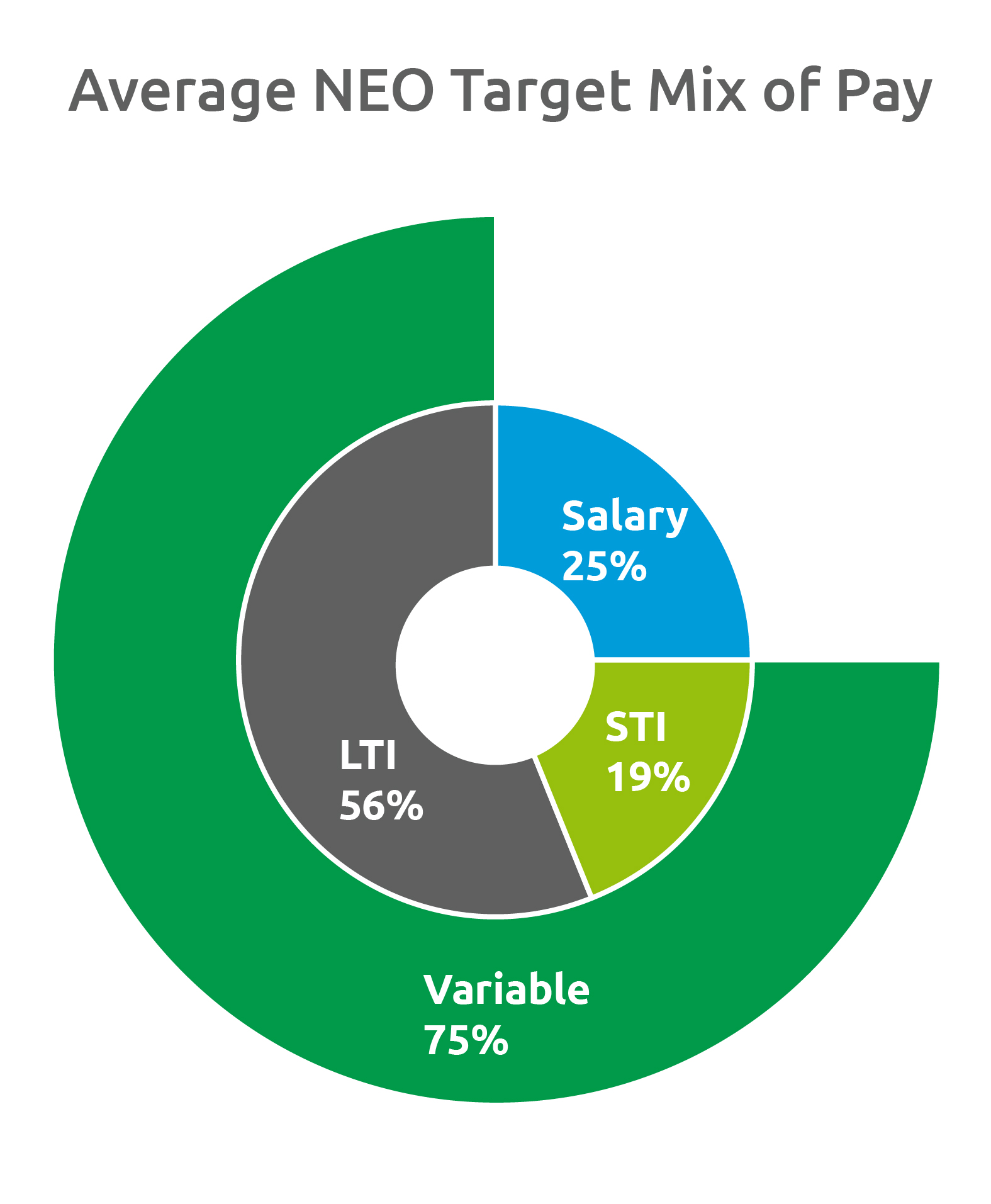

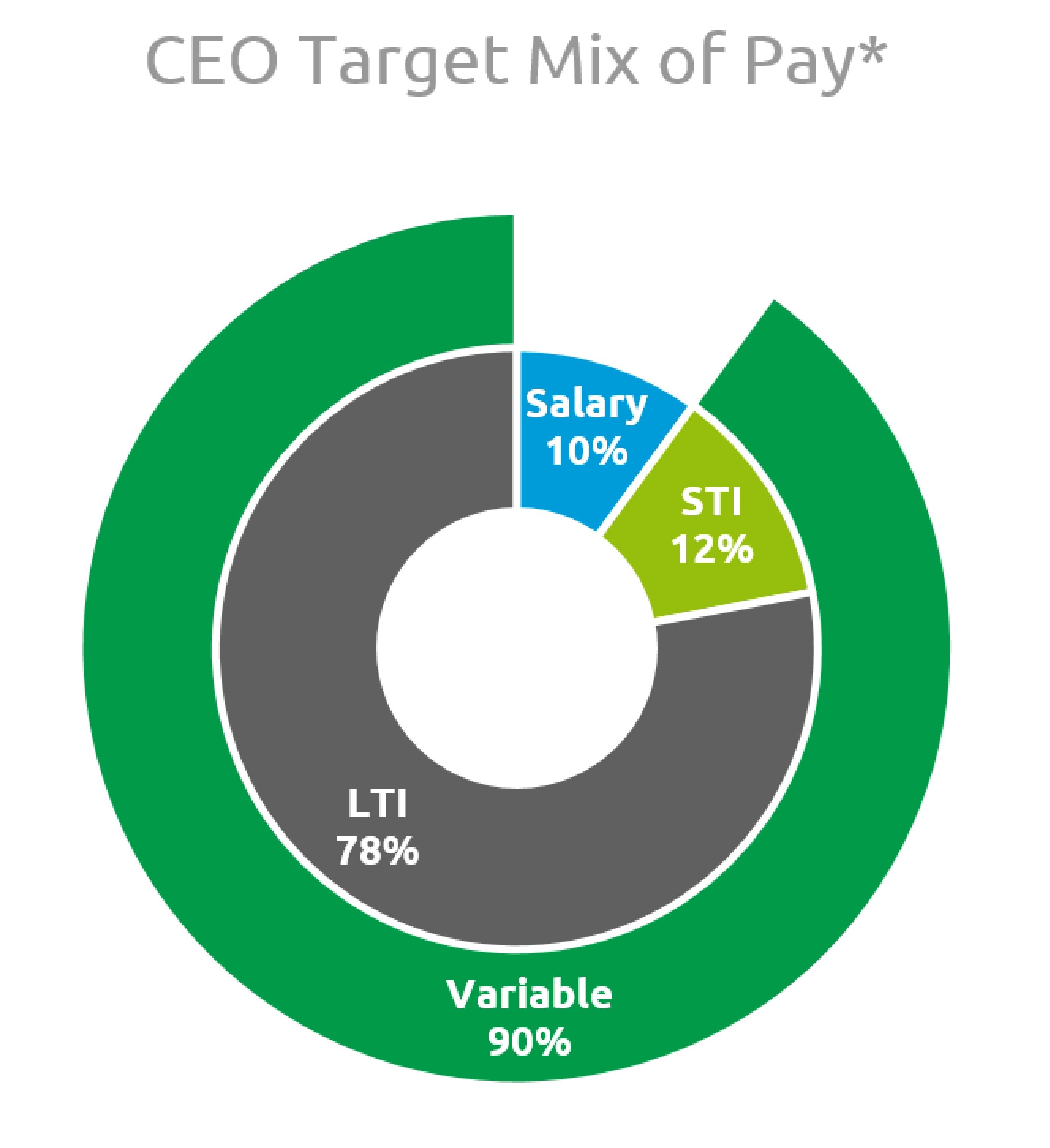

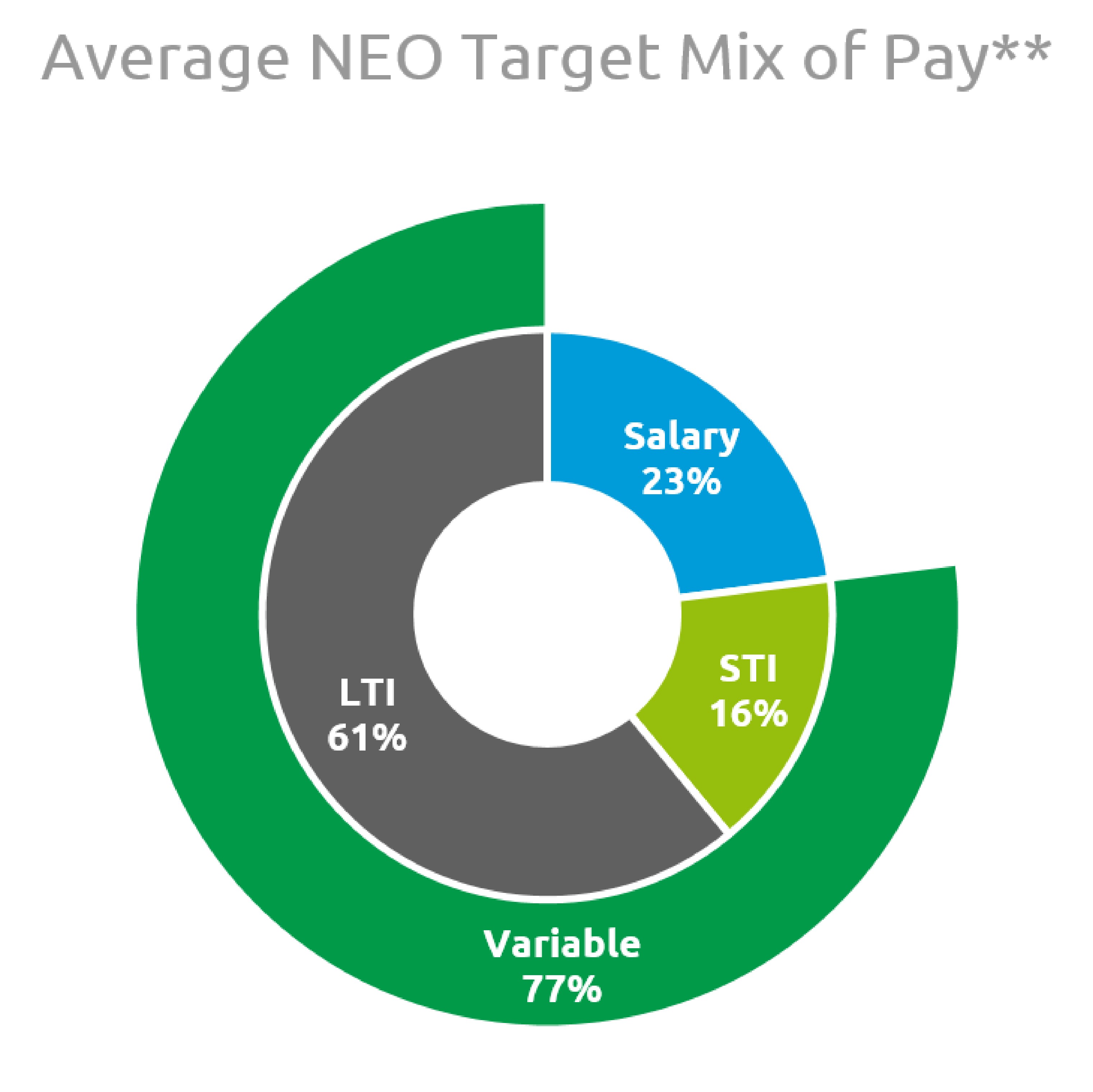

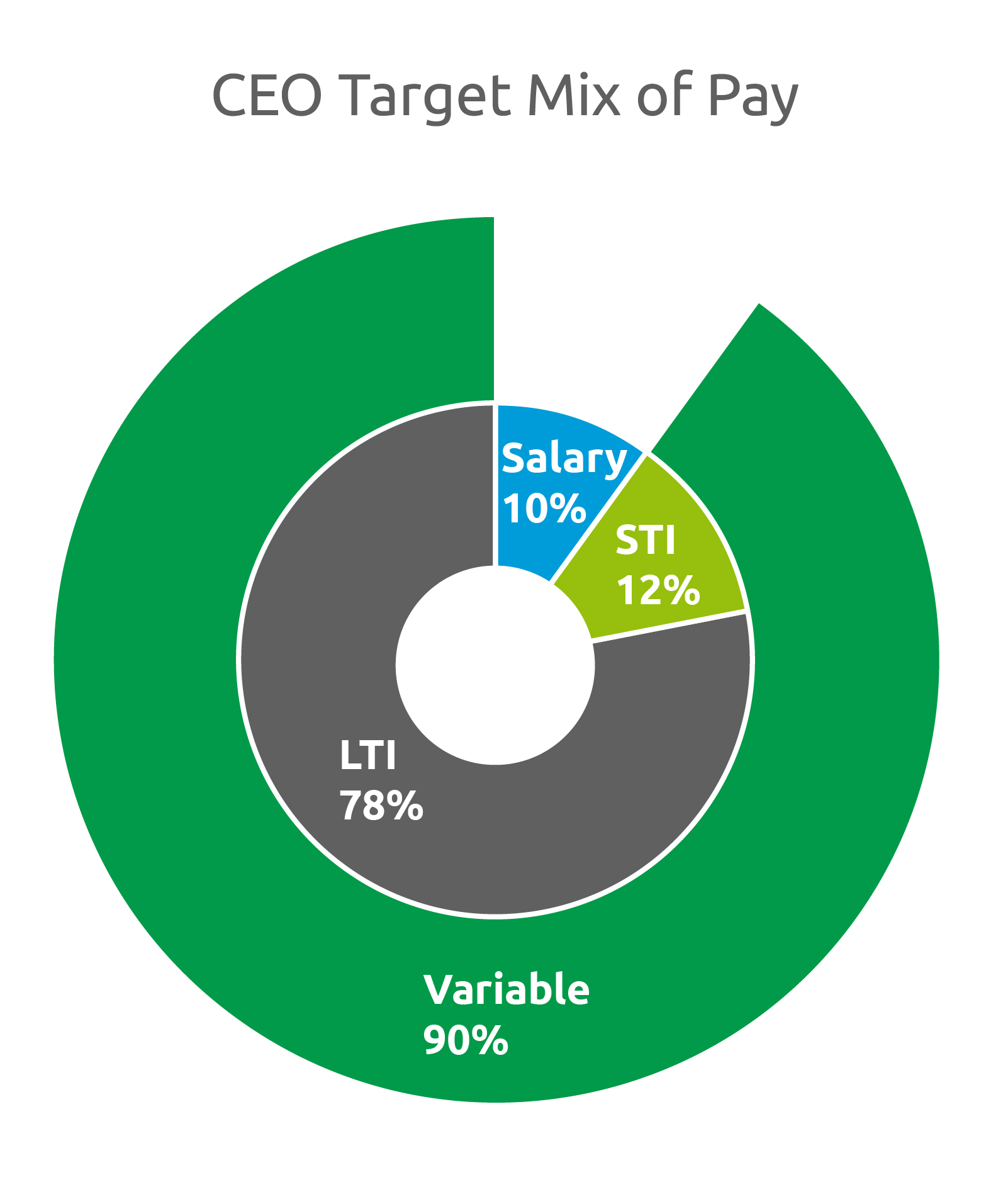

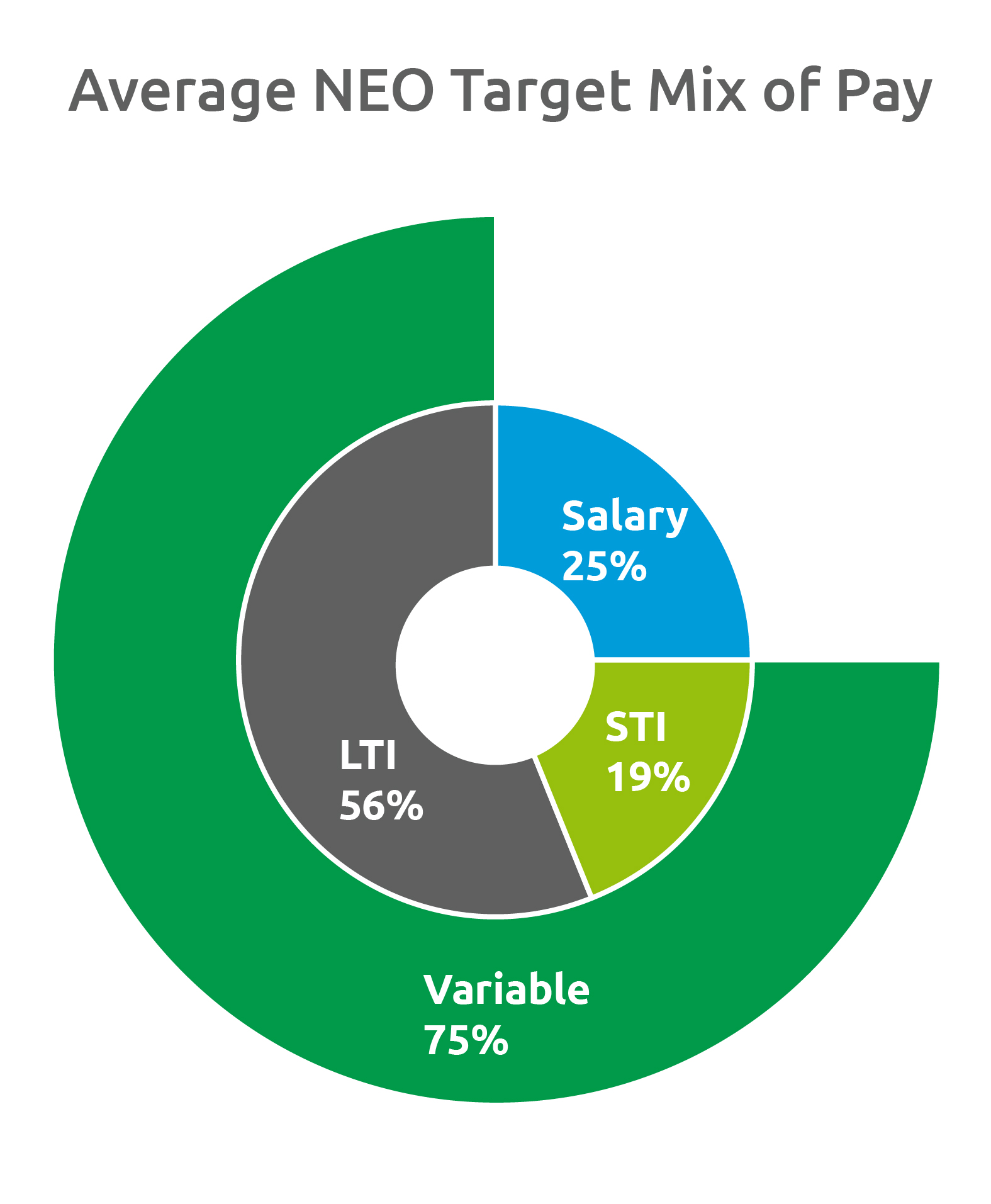

The goal of our executive compensation program is to create long-term value for our investors while at the same time rewarding our executives for superior financial performance and encouraging them to remain with us for long, productive careers. The core elements of our 2023 executive compensation philosophy were that compensation be:

•Market competitive

•Performance-based

•Investor aligned

•Financially efficient

Our 2023 executive compensation program consisted of the following elements: base salary, annual incentive compensation and long-term equity incentive compensation in the form of restricted stock units, which are discussed in more detail in the Executive Compensation section of this proxy statement. Each element is intended to reward and motivate executives in different ways consistent with MultiPlan’s overall guiding principles for compensation.

We are committed to sound executive compensation practices and corporate governance principles, and are working to ensure that our practices protect and further the interests of stockholders. We believe that our executive compensation program is structured to promote a performance-based culture which links the interests of management and stockholders and to support our business objectives. Our compensation elements seek to balance all aspects of an executive’s responsibilities: base salary for day-to-day responsibilities, cash incentive bonus for shorter-term returns linked to annual Company performance, and long-term incentive compensation for aligning the executives’ focus with stockholder value and the long-term, future performance of the Company.

As discussed further in the Compensation Discussion and Analysis of this Proxy Statement, 2023 was a successful year for MultiPlan, both in terms of the financial performance we delivered, which was in line with our expectations, but also the tangible progress we made on our growth plan and improving our capital structure. The actions and efforts of the management team in 2023 further positioned MultiPlan for the future without sacrificing financial performance in the current year.

Given our financial performance in 2023 was in line with our expectations, our compensation program for 2023 worked as intended and consistent with our performance-based philosophy. Payouts in connection with our annual cash incentive plan were 100% of target for each of our non-CEO named executive officers and 89% of target for our CEO, who elected to forego $100,000 of his incentive cash payout for 2023 to reward other employees (excluding executive officers). Further, in line with our sound executive compensation practices and as a result of our depressed stock price at the time of our 2023 annual equity grants, we decided to not award stock options as a portion of our equity compensation program.

Finally, in 2023, we laid the groundwork to allow us to implement performance stock units as a component of our equity compensation program in 2024. To that end, on March 1, 2024, we made our annual equity awards, which for our named executive officers were comprised of 50% performance stock units, with the remaining 50% being in the form of restricted stock units. The performance stock units are subject to two financial metrics, revenue and relative total stockholder return, each weighted at 50%. Further, the performance stock units are also subject to a three-year service requirement. We believe the implementation of performance stock units: (i) increases the portion of our executive compensation program that is performance-based; (ii) further aligns the interests of our senior leaders with our stockholders; and (iii) incentivizes superior performance over an extended period.

| | | | | | | | | | | | | | |

| | | | |

| PROPOSAL 4 | | |

| APPROVAL OF THE AMENDMENT TO THE MULTIPLAN CORPORATION 2020 OMNIBUS INCENTIVE PLAN | | |

| | | |

| | | |

| | THE BOARD RECOMMENDS A VOTE FOR THIS PROPOSAL | | |

| | | | |

We believe thatare asking our stockholders to approve an increase in the number of shares available for grant under the MultiPlan Corporation 2023 Employee Stock Purchase2020 Omnibus Incentive Plan (the “ESPP”), if approved, will advanceso that we can continue to offer equity incentive awards. Our continuing ability to offer equity incentive awards is critical to our ability to attract, motivate, and retain qualified personnel. This increase in the interestsnumber of the Company and its stockholders by providing eligible employees with a program for the regular purchaseshares available is essential to meet our forecasted needs in respect of our common stock from the Company through periodic payroll deductions. The ESPP gives eligible employees a convenient and cost-effective means to acquire a proprietary interest in our Company at a discounted price and thereby provides them with an additional incentive to contribute to the long-term profitability and success of our Company and its subsidiaries.equity incentives.

Corporate Governance and Board Matters

| | | | | | | | | | | |

| | | |

| PROPOSAL 1 | |

| ELECTION OF DIRECTORS | |

| | |

| | |

| | THE BOARD RECOMMENDS A VOTE FOR EACH OF THE CLASS II AND CLASS IIII DIRECTOR NOMINEES | |

| | | |

MultiPlan Board of Directors

Board Classification

Our Board of Directors (the “Board”) currently consists of thirteen (13) members. However, with the retirement of Mark H. Tabak from our Board scheduled to become effective on April 24, 2024 (by virtue of Mr. Tabak not standing for re-election), our Board has reduced the number of directors on our Board to twelve (12) members:effective as of the date of our Annual Meeting of Stockholders.

| | | | | | | | |

| | |

| CLASS I DIRECTORS: | CLASS II DIRECTORS: | CLASS III DIRECTORS: |

| Michael K. Attal | Glenn R. August | Anthony Colaluca, Jr. |

C. Martin HarrisTravis S. Dalton | Richard A. Clarke | Michael S. Klein |

John M. PrinceC. Martin Harris | Julie D. Klapstein | Allen R. Thorpe (Lead Director) |

Mark H. Tabak (Chairperson)

John M. Prince | P. Hunter Philbrick | Dale A. White(Chair) |

| Mark H. Tabak | | |

Our directors are divided into three classes serving staggered three-year terms. Class I, Class II, and Class III directors will serve until our annual meetings of stockholders in 2024, 2025, and 2023,2026, respectively. At each annual meeting of stockholders, directors will be elected to succeed the class of directors whose terms are expiring. This classification of our Board could have the effect of increasing the length of time necessary to change the composition of a majority of the Board.

Selection of Nominees

The Board is responsible for selecting director nominees to stand for election by stockholders. The Board shall act appropriately, andacts in accordance with the applicable provisions of the Investor Rights Agreement, dated as of July 12, 2020 and amended as of January 31, 2022 and December 28, 2023, by and among the Company, Churchill Sponsor III, LLC (“Sponsor”), Polaris Investment Holdings, L.P. (“Holdings”), Hellman & Friedman Capital Partners VIII, L.P. (“H&F”), The Public Investment Fund of the Kingdom of Saudi Arabia, and certain other parties (as amended from time to time, the “Investor Rights Agreement”), and applicable law, to nominate individuals to serve as members of the Board, to fill vacancies on the Board, to serve on Board committees and to comply with such other matters as may be specified in the Investor Rights Agreement. Pursuant to the Investor Rights Agreement, H&F, in its capacity as the Seller Representative (as defined in the Investor Rights Agreement), currently has the has the right to designate three director nominees and the Sponsor currently has the right to designate two director nominees. Messrs. Attal, Philbrick, and Thorpe were designated by H&F and Messrs. August and Klein were designated by the Sponsor. Stockholders may also nominate directors for election at the Company’s annual stockholders meeting by following the provisions set forth in the Company’s bylaws or those set forth in Rule 14a-19 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). See “Miscellaneous Matters—Submitting Proposals for 20242025 Annual Meeting” in this proxy statement for more information.

Nomination Process

The Nominating and Corporate Governance Committee is responsible for reviewing the qualifications of potential director candidates and recommending for the Board’s selection those candidates to be nominated for election to the Board, subject to any obligations and procedures governing the nomination of directors to the Board that may be set forth in the Investor Rights Agreement to which the Company is party. The Nominating and Corporate Governance Committee utilizes a variety of methods for identifying and evaluating nominees for director. When the Committee seeks a new candidate for directorship, it seeks qualifications from the individual that will complement or supplement the skills, attributes and perspectives of the other members of the Board. The Nominating and Corporate Governance Committee takes into consideration whether particular

| | | | | |

20232024 Proxy Statement | 1113 |

Corporate Governance and Board Matters

individuals satisfy the independence criteria set forth in the NYSE Listed Company Manual, together with any special criteria applicable to service on various committees of the Board.

Shareholders may recommend potential director candidates to the Nominating and Corporate Governance Committee and any such candidates will be evaluated on a substantially similar basis as the Nominating and Corporate Governance Committee considers other nominees. See “—Communications with the Board of Directors” and “Miscellaneous Matters—Submitting Proposals for 20242025 Annual Meeting” in this proxy statement for more information.

Director Qualifications

The Nominating and Corporate Governance Committee considers (a) minimum individual qualifications, including strength of character, mature judgment, industry knowledge or experience, and an ability to work collaboratively with the other members of the Board and (b) all other factors it considers appropriate, which may include age, diversity of background, existing commitments to other businesses, service on other boards of directors or similar governing bodies of public or private companies or committees thereof, potential conflicts of interest with other pursuits, legal considerations such as antitrust issues, corporate governance background, financial and accounting background, executive compensation background, and the size, composition and combined expertise of the existing Board. The Board monitors the mix of specific experience, qualifications, and skills of its directors in order to assure that the Board, as a whole, has the necessary tools to perform its oversight function effectively in light of the Company’s business and structure.

Director Tenure and Board Refreshment

The Nominating and Corporate Governance Committee considers and makes recommendations to the Board concerning the appropriate size and needs of the Board. The Board determines the appropriate Board size, taking into consideration such recommendation of the Nominating and Corporate Governance Committee, and any parameters set forth in the Company’s certificate of incorporation and bylaws, as well as any contractual obligations of the Company.

| | | | | | | | | | | |

| 1 | Director Tenure Policies | Allow the Board to ease future transitions | |

Term Limits: The Board recognizes that it is important for the Board to balance the benefits of continuity with the benefits of fresh viewpoints and experience. Therefore, the Board will not nominate for re-election any non-executive director if the director shall havehas completed 15 years of service as a member of the Board on or prior to the date of the election as to which the nomination relates. Retirement Age: Directors are required to retire from the Board when they reach the age of 75. A director elected to the Board prior to his or her 75th birthday may continue to serve until the annual stockholders meeting coincident with or next following his or her 75th birthday. On the recommendation of the Nominating and Corporate Governance Committee, the Board may waive this requirement as to any director if it deems such waiver to be in the best interests of the Company. |

| | |

| 2 | Evaluation of Board Performance | Assess whether our Board, our directors, and our committees are functioning effectively |

| | |

| 3 | Director Elections | Elect new directors and fill director vacancies |

Director Independence

A majority of the Board shall be comprised of directors meeting the independence requirements of the NYSE. The Company defines an “independent” director in accordance with Section 303A.02 of the NYSE’s Listed Company Manual. The NYSE independence definition includes a series of objective tests, including that the director is not an employee of the Company and has not engaged in various types of business dealings with the Company. Because it is not possible to anticipate or explicitly provide for all potential conflicts of interest that may affect independence, the Board is also responsible for determining affirmatively, as to each independent director, that no material relationships exist which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, the Board will broadly consider all relevant facts and circumstances, including information provided by the directors and the Company with regard to each director’s business and personal activities as they may relate to the Company and the Company’s management. As the concern is independence from management, the Board does not view ownership of even a significant amount of stock, by itself, as a bar to an independence finding. No director may serve on the Audit Committee or the Compensation Committee of the Board unless such director meets all of the applicable criteria established for service in each such committee by NYSE rules and any other applicable rules or laws.

Corporate Governance and Board Matters

The Board makes an affirmative determination at least annually as to the independence of each director. The Board has determined that each of Messrs. Attal, August, Clarke, Colaluca, Harris, Klein, Philbrick, Prince and Thorpe and Ms. Klapsteinare independent directors under applicable Securities and Exchange Commission (“SEC”) and NYSE rules.

Class III Director Nominees

Our Board has nominated four Class III directors for re-electionelection at the StockholdersAnnual Meeting to hold office until our annual meeting of stockholders in 20252027 and until his or her successor has been duly elected and qualified or until his or her earlier resignation, retirement, death, disqualification or removal. All of the nominees have been directors since prior to the 2022 Meeting, were submitted to a vote of the stockholders at our 2022 Meeting, and each received the required vote to be elected at the 2022 Meeting. To the extent that there was a technical defect in the election of such directors at the 2022 Meeting, such directors remained on the Board as holdoverare currently directors. In order to ensure that these directors are properly elected directors, and not holdover directors, we are re-submitting the election of such directors to a vote of stockholders at the Stockholders Meeting. These nominees bring a wide set of individual talents to their oversight responsibilities, including a full array of business and leadership skills. Their diversity of experience and expertise facilitates robust and thoughtful decision-making as a Board.

Each agreed to be named in this proxy statement and to serve if elected. We have no reason to believe that any of the nominees will be unable to serve. However, if, before the election, one or more of the nominees should become unable to serve or for good cause will not serve, proxies will be voted for the remaining nominees and for any substitute nominees to be selected by the Nominating and Corporate Governance Committee and approved by the Board.

| | | | | |

| |

Michael K. AttalINDEPENDENT

Principal, Hellman & Friedman LLC | | | | | Age: 31

Committees: Audit (Observer) and Risk |

| |

| |

BIOGRAPHY Michael K. Attal has served as a member of our Board since August 2022. Mr. Attal has served as a Principal at Hellman & Friedman LLC since November 2019 and prior to that served as an associate at Hellman & Friedman LLC since July 2016. He is active in the firm’s investment in Medline (a private company). He was also formerly active in the firm’s investment in PPD, Inc. (a public company before it was acquired by Thermo Fisher in 2021). Prior to joining Hellman & Friedman LLC in 2016, Mr. Attal worked as an investment banker in the mergers and acquisitions department of Morgan Stanley & Co. SKILLS AND QUALIFICATIONS Mr. Attal is qualified to serve as a director due to his financial acumen, experience in the healthcare industry, experience with environmental, social, and governance matters, and mergers and acquisition experience. |

| |

| | | | | |

| |

Travis S. Dalton

President and Chief Executive Officer, MultiPlan Corporation | Age: 53 Committees: None |

| |

| |

BIOGRAPHY Travis S. Daltonhas served as President and Chief Executive Officer of MultiPlan and as a member of our Board since March 1, 2024, overseeing and executing on the Company’s commitment to helping healthcare payors manage the cost of care, improve their competitiveness and inspire positive change. Prior to that, Mr. Dalton served as General Manager and Executive Vice President of Oracle Health, which is part of Oracle Corporation (a public company). Prior to Oracle Health, Mr. Dalton served in various roles at Cerner Corporation from 2001 until the acquisition of Cerner by Oracle in June 2022, most recently as Chief Client & Services Officer and President, Cerner Government Services, a role he held from 2012 until June 2022. Cerner was publicly traded until its acquisition by Oracle. Prior to Cerner, Mr. Dalton was a consultant at Accenture. Mr. Dalton serves on the board of the Elizabeth Dole Foundation, a non-profit organization that supports and honors the spouses, parents, family members and friends who care for America's wounded, ill or injured veterans. SKILLS AND QUALIFICATIONS Mr. Dalton is qualified to serve as a director due to his extensive experience in, and knowledge of, the healthcare industry, especially with respect to innovation, technology and data, as well as his role as our current Chief Executive Officer. |

| |

Corporate Governance and Board Matters

| | | | | |

| |

C. Martin HarrisINDEPENDENT

AVP of the Health Enterprise and Chief Business Officer, Dell Medical School at The University of Texas at Austin | Age: 67

Committees: Risk |

| |

| |

BIOGRAPHY C. Martin Harris, MD, MBAhas served as a member of our Board since January 2021. Dr. Harris has served as Associate Vice President of the Health Enterprise and Chief Business Officer at the Dell Medical School at The University of Texas at Austin since December 2016. Previously, he was CIO and Chairman of the Information Technology Division, as well as a Staff Physician, at The Cleveland Clinic Foundation Department of General Internal Medicine. He also served as a Staff Physician for the Cleveland Clinic Hospital. Dr. Harris currently serves on the board of directors of three other public companies, Agiliti, Inc., Thermo Fisher Scientific, and Colgate-Palmolive Company. He also served on the board of directors of HealthStream, Inc., a public company, from September 2010 through February 2021, and Invacare Corporation, a public company, from 2003 through May 2022. SKILLS AND QUALIFICATIONS Dr. Harris is qualified to serve as a director due to his extensive experience in the healthcare industry as a leader of healthcare organizations and his expertise in the use of information technology in the healthcare industry, as well as his board-level experience from his many years served on public company boards in the healthcare industry. |

| |

| | | | | |

| |

John M. PrinceINDEPENDENT

Former President and Chief Operating Officer, Optum | Age: 56

Committees: Audit |

| |

| |

BIOGRAPHY John M. Prince has served as a member of our Board since June 2023. Mr. Prince has served as an Operating Partner at Advent International Corporation and as a Senior Advisor to TPG Global LLC since June 2023. Mr. Prince was President and Chief Operating Officer of Optum, UnitedHealth Group’s (a public company) health services platform, from April 2021 until June 2023. From April 2017 until April 2021, he served as Chief Executive Officer of Optum Rx, Optum’s pharmacy care services business. From 2005 to 2017, Mr. Prince held numerous other executive leadership roles at UnitedHealth Group. Prior to joining UnitedHealth Group, he served as Senior Vice President and Head of Health Care Business Development and Strategy for JPMorgan Chase (a public company) from 2002 and 2005. Between 1991 and 2002, Mr. Prince worked in Arthur Andersen’s healthcare strategy and operations consulting practice, most recently as a partner. Mr. Prince is a member of Northwestern University’s Healthcare at Kellogg Advisory Council. He previously served on the boards of Truepill, a digital health start-up, the Executives’ Club of Chicago, a senior executive membership and networking organization, the Minneapolis Institute of Art, and the Pharmaceutical Care Management Association, a national association representing America’s pharmacy benefit companies, where he served as chair. SKILLS AND QUALIFICATIONS Mr. Prince is qualified to serve as a director due to his extensive knowledge of the healthcare industry and his substantial leadership experience at UnitedHealth Group (a large, national health care and well-being company), including his leadership of Optum, a subsidiary of UnitedHealth Group focused on delivering healthcare solutions aided by technology and data. |

| |

Corporate Governance and Board Matters

Continuing Directors

Class II Directors

| | | | | |

| |

Glenn R. August INDEPENDENT

Founder, Senior Partner and Chief Executive Officer,

Oak Hill Advisors | Age: 62

Committees: Nominating and Corporate Governance

|

| |

| |

BIOGRAPHY Glenn R. August has served as a member of our Board since the Initial Public Offering of Churchill IPO.Capital Corp III (the “Churchill IPO”). He has served as a vice president and director of T. Rowe Price Group, Inc., a publicly-traded investment management company, since December 2021 when T. Rowe Price Group acquired Oak Hill Advisors, L.P. to operate as a standalone business within T. Rowe Price. Mr. August is the Founder and Chief Executive Officer of Oak Hill Advisors, L.P., a leading alternative investment firm. Mr. August and has overall management responsibility for OHA. In addition he serves as global head of the firm’s distressed investment activities and chairs or serves on various firmOHA committees, including the investment strategy committee and several fund investment committees. In 2021, T. Rowe Price Group, Inc. acquired Oak Hill Advisors, L.P. and operates it as a standalone business. Since December 2021, Mr. August has been an executive officer and vice president of T. Rowe Price Group, Inc. and has served on its Management Committee and on its Board of Directors. Mr. AugustHe co-founded the predecessor investment firm to Oak Hill Advisors, L.P.OHA in 1987 and took responsibility for the firm’s credit and distressed investment activities in 1990. HeMr. August has played leadership roles in numerous restructurings and, since 1987, has served on 18eighteen corporate boards. HeIn addition to T. Rowe Price, Mr. August currently serves on the Board of Directorsboard of Lucid Group, Inc., a NASDAQ-traded company and AKBANK, a publicly traded company. Mr. August has served on the Board of Trustees of Horace Mann School since June 2009 and The Mount Sinai Medical Center since March 2011. He has also served on the Board of Directors of the Partnership for New York City since January 2021 and the 92nd Street Y since June 2002. Mr. August previously served on the Board of Directors for Cooper Standard Automotive until May 2017 and OHA Investment Corporation until December 2019.publicly-traded automaker. He also previously served on the Board of Directors of several publicly-traded blank check companies: Churchill Capital CorporationCorp II (now Skillsoft) until June 2021, Churchill Capital CorporationCorp V until December 2021, Churchill Capital CorporationCorp VI until December 2021, and Churchill Capital CorporationCorp VII until December 2021. Mr. August also serves on the Board of Trustees of Horace Mann School and The Mount Sinai Medical Center, and on the Board of Directors of the Partnership for New York City and the 92nd St. Y. He earned an M.B.A. from Harvard Business School, where he was a Baker Scholar, and a B.S. from Cornell University. SKILLS AND QUALIFICATIONS Mr. August is qualified to serve as a director due to his extensive corporate finance and operational experience in both public and privately owned multi-national technology businesses. |

| |

| | | | | |

20232024 Proxy Statement | 1317 |

Corporate Governance and Board Matters

| | | | | |

| |

Richard A. Clarke INDEPENDENT

Chief Executive Officer, Good Harbor Security

Risk Management | Age: 7273

Committees: Risk (Chair)

|

| |

| |

BIOGRAPHY Richard A. Clarke has served as a member of our Board since October 2020, and served as a director of Polaris Parent Corp. (“MultiPlan ParentParent”), the former parent company of MultiPlan before MultiPlan became a public company, from October 2016 through October 2020. Since 2012, Mr. Clarke has served as Chief Executive Officer of Good Harbor Security Risk Management, a private consultancy specializing in cybersecurity for enterprises and mid-cap companies in aviation, insurance, finance, health, technology, and media. He is an advisor at Paladin Capital group, a venture capital firm. In addition, Mr. Clarke is the Chairman of the Board of Governors, Middle East Institute of Washington, D.C. and a member of the Board of Directors of Visible Assets, a private physical security device manufacturer. Mr. Clarke served for thirty years in the United States Government, serving three consecutive Presidents. In the White House, he served as America’s first “Counter-Terrorism Czar” and its first “Cyber Czar.” Prior to his White House years, he served as a diplomat. He was confirmed as Assistant Secretary of State, and held other positions in the State Department (Deputy Assistant Secretary of State for Intelligence) and the Pentagon for twenty years. Since leaving government in 2003, Mr. Clarke has served as an on-air consultant for ABC News for fifteen years and taught at Harvard’s Kennedy School of Government for five years. He is the author of tennumerous books, including WARNINGS, on risk management, THE FIFTH DOMAIN and CYBER WAR on cyber security, and AGAINST ALL ENEMIES on terrorism and national security. Mr. Clarke was co-chair of Virginia Governor McAuliffe’s Cybersecurity Commission and he also served on the New York Cybersecurity Advisory Board. Mr. Clarke was formerly a member of President Obama’s Review Group on Intelligence and Technology. He has served as a director of several private companies, including Veracode, Inc., Carbon Black, Inc. (f/k/a Bit9, Inc.), Sectigo Inc., BlueCat Networks, Inc. and Nok Nok Labs, Inc. He has also served on private company corporate advisory boards, including RedSeal, Inc., Awake Security, Inc., Red Five Security, LLC and HawkEye 360, Inc. SKILLS AND QUALIFICATIONS Mr. Clarke is qualified to serve as a director due to his extensive knowledge and experience of cybersecurity and security risk management. |

| |

| | | | | |

| |

Julie D. Klapstein INDEPENDENT

Former Chief Executive Officer, Availity, LLC | Age: 6869

Committees: Audit and Compensation

|

| |

| |

BIOGRAPHY Julie D. Klapstein has served as a member of our Board since November 2020. Ms. Klapstein was the founding Chief Executive Officer of Availity, LLC (a private company), a health information network optimizing the automated delivery of critical business and clinical information among healthcare stakeholders. She served as Availity’s Chief Executive Officer and board member from 2001 to 2011. She also served as the interim Chief Executive Officer at Medical Reimbursements of America, Inc., a private company, from February 2017 to June 2017. Ms. Klapstein has more than 30 years of experience in the healthcare information technology industry including executive roles at healthcare companies including Phycom, Sunquest Information Systems, SMS’ Turnkey Systems Division and GTE Health Systems. Her early career with AT&T Information Systems also focused on the healthcare industry. Ms. Klapstein currently serves as the lead director of Amedisys, a NASDAQ-listedpublic company, and is a member ofincluding on the quality of care, compensation, and nominating and governance committees. She also serves on the boards of NextGen Healthcare, a NASDAQ-listed company, including on the audit and compensation committees; Oak Street Health, a NYSE-listed company, including on the compliance committee and chair of the compensation committee;committees, and Revecore, a private company. Ms. Klapstein served on the board of NextGen Healthcare from 2017 until November 2023, when it was acquired by Thoma Bravo and ceased being publicly-traded, and Oak Street Health from 2020 until May 2023, when it was acquired by CVS and ceased being publicly-traded. SKILLS AND QUALIFICATIONS Ms. Klapstein is qualified to serve as a director due to her extensive experience in the healthcare and healthcare technology industries, having served in executive capacities for multiple healthcare technology companies, as well as her public company board experience. |

| |

Corporate Governance and Board Matters

| | | | | |

| |

P. Hunter Philbrick INDEPENDENT

Partner, Hellman & Friedman LLC | Age: 4344

Committees: Compensation (Chair) and Nominating and Corporate Governance |

| |

| |

BIOGRAPHY P. Hunter Philbrick has served as a member of our Board since October 2020, and served as a director of MultiPlan Parent from October 2016 through October 2022. Mr. Philbrick has served as a Partner at Hellman & Friedman LLC since January 2013. Prior to joining Hellman & Friedman LLC in 2003, Mr. Philbrick worked as an investment banker in the mergers, acquisitions and restructuring and general industrial departments of Morgan Stanley & Co. He currently serves as a member of the board of directors of several private companies, including Cordis, Vantage Group Holdings, Ltd., and Hub International Limited. Mr. Philbrick was formerly a director of Change Healthcare Inc., a NASDAQ-traded (a public company before it was acquired by UnitedHealth in 2022,2022), GeoVera Insurance Holdings Ltd., a (a private company,company), PPD, Inc., a NASDAQ-traded (a public company before it was acquired by Thermo Fisher in 2021,2021), and Sedgwick Inc., a (a private company.company). SKILLS AND QUALIFICATIONS Mr. Philbrick is qualified to serve as a director due to his finance and capital markets experience as well as insight into the healthcare industry, gained from advising and serving as a director of multiple Hellman & Friedman LLC portfolio companies. |

| |

Class III Director Nominees

Our Board has nominated four Class III directors for re-election at the Stockholders Meeting to hold office until our annual meeting of stockholders in 2026 and until his or her successor has been duly elected and qualified or until his or her earlier resignation, retirement, death, disqualification or removal. All of the nominees have been directors since prior to the April 2023 Meeting, were submitted to a vote of the stockholders at our April 2023 Meeting, and each received the required vote to be elected at the April 2023 Meeting. To the extent that there was a technical defect in the election of such directors at the April 2023 Meeting, such directors remained on the Board as holdover directors. In order to ensure that these directors are properly elected directors, and not holdover directors, we are re-submitting the election of such directors to a vote of stockholders at the Stockholders Meeting. These nominees bring a wide set of individual talents to their oversight responsibilities, including a full array of business and leadership skills. Their diversity of experience and expertise facilitates robust and thoughtful decision-making as a Board.Directors

| | | | | |

| |

Anthony Colaluca, Jr. INDEPENDENT President, AfterNext HealthTech Acquisition Corp.Colaluca Business Advisors LLC | Age: 5657 Committees: Audit (Chair) and Compensation |

| |

| |

BIOGRAPHY Anthony Colaluca, Jr. has served as a member of our Board since October 2020. He has served as the President of AfterNext HealthTech Acquisition Corp., a publicly-traded special purpose acquisition company, since July 2021. He has also served asis the President of Colaluca Business Advisors LLC, where he servedserves as an independent consultant providing business and financial advisory services primarily to private equity firms, since January 2011. He previously served as the President of AfterNext HealthTech Acquisition Corp., a publicly-traded special purpose acquisition company, from July 2021 until August 2023. From March 2015 to February 2016, he served as Chief Financial Officer and Executive Vice President of MedAssets, Inc., a healthcare performance improvement company. From 2005 through 2010, he served as Chief Financial Officer and Executive Vice President of Intergraph Corporation, a global provider of engineering and geospatial software. Prior to joining Intergraph Corporation, he served as Chief Financial Officer for Harland Financial Solutions, Inc., a software division of John H. Harland Company. Previously, Mr. Colaluca also served as Chief Financial Officer for Novient, Inc./Solution 6 North America, and Chief Financial Officer for Computer Management Sciences Inc. Earlier in his career, he was a senior manager with KPMG LLP and a certified public accountant in the State of New York. Mr. Colaluca currently serves on the board of directors of AfterNext HealthTech Acquisition Corp.Nextech Systems, a private healthcare software company, and Feeding Northeast Florida.Florida, a non-profit. He previously served as a director of AfterNext HealthTech Acquisition Corp. (a public company) from July 2021 until August 2023 and as a director of Tekelec (a public company), and member of its audit and compensation committees, from February 2011 until the company was taken private in January 2012. SKILLS AND QUALIFICATIONS Mr. Colaluca is qualified to serve as a director due to his extensive financial and operational experience in both public and privately owned multi-national technology businesses. |

| |

| | | | | |

20232024 Proxy Statement | 1519 |

Corporate Governance and Board Matters

| | | | | |

| |

Michael S. Klein INDEPENDENT

Founder and Senior Member, M. Klein & Company, LLC | Age: 5960

Committees: None |

| |

| |

BIOGRAPHY Michael S. Klein has served as a member of our Board Director since the Churchill IPO, in February 2020, and previously served as Churchill’s Chief Executive Officer and President from February 2020 to October 2020. Mr. Klein is the founder and managing partner of M. Klein & Company, LLC (“M. Klein & Co.”), which he founded in 2012. M. Klein & CompanyCo. is a global strategic advisory firm that provides its clients a variety of advice tailored to their objectives. Mr. Klein is also the Chief Executive Officer and Chairman of Churchill Capital Corp V, Churchill Capital Corp VI and Churchill Capital Corp VII, which areis a publicly-traded blank check companiescompany whose sponsors aresponsor is an affiliate of M. Klein & Company, LLC.Co. Mr. Klein also serves on the board of directors of Skillsoft, an entity which merged with Churchill Capital Corp II in June 2021.2021 and is now publicly-traded. Prior to the merger, Mr. Klein served as the CEO and Chairman of the board of directors of Churchill Capital Corp II. Mr. Klein is currently a director of Magic Leap (a private company), TGB Europe NV (a private company), and AltC Acquisition Corp., and he (a public company). He also holds positions as a board member and/or adviser for multiple charitable organizations. HeMr. Klein served on the boardBoard of directorsDirectors of Credit Suisse Group AG and Credit Suisse AG from 2018 until October 2022. Mr. Klein was the co-founderCo-Founder and Chairman of Churchill Capital Corp, a blank check company formed in 2018. Churchill Capital Corp merged with Clarivate Analytics in May 2019, and Mr. Klein served on the board of directors of Clarivate Analytics through October 2021. He also served onMr. Klein was the board of directorsCo-Founder and Chairman of Churchill Capital Corp.Corp IV, a publicly-traded blank check company formed in July 2020 until its merger2020. Churchill Capital Corp IV merged with Lucid Motors in July 2021. Mr. Klein was Chairman of Churchill Capital Corp V until October 2023 and Churchill Capital Corp VI until December 2023. Mr. Klein is a strategic advisor to global companies, boards of directors, senior executives, governments and institutional investors. Mr. Klein’s background in strategic advisory work was built during his 30-year career, including more than two decades at CitiCitigroup Inc., a publicly-traded, global financial services company, and its predecessors, during which he initiated and executed strategic advisory transactions. He began his career as an investment banker in the M&A Advisory Group at Salomon Smith Barney and subsequently became Chairman and Co-Chief Executive Officer of Citi Markets and Banking, with responsibilities for global corporate and investment banking and Global Transaction Services across Citi. SKILLS AND QUALIFICATIONS Mr. Klein is qualified to serve as a director due to his significant investment banking and advisory experience, including for companies in information services. |

| | | | | |

| |

Allen R. Thorpe LEAD INDEPENDENT DIRECTOR

Partner, Hellman & Friedman LLC | Age: 5253

Committees: Nominating and Corporate Governance (Chair) |

| |

| |

BIOGRAPHY Allen R. Thorpe has served as a member of our Board since October 2020, and served as a director of PolarisMultiPlan Parent, Corp. (“MultiPlan Parent”), the former parent company of MultiPlan before MultiPlan became a public company, from June 2016 through October 2020. Mr. Thorpe has served as a Partner of Hellman & Friedman LLC, a private equity firm, since January 2004 and leads the firm’s New York office. Prior to joining Hellman & Friedman LLC in 1999, Mr. Thorpe was a vice president with Pacific Equity Partners in Australia, a private equity firm, and was a manager at Bain & Company, Inc., a management consulting firm. He currently serves on the board of directors of Edelman Financial Engines LLC (a private company), Medline Inc. (a private company), athenahealth (a private company), and Caliber Collision (a private company). Mr. Thorpe also previously served as Chairman of Sheridan Healthcare, Inc. (a private company), a director of PPD, Inc. (a NASDAQ-tradedpublic company before it was acquired by Thermo Fisher in 2021), Change Healthcare Inc. (a NASDAQ-tradedpublic company before it was acquired by UnitedHealth in 2022), Mitchell International Inc. (a private company), Artisan Partners Asset Management Inc. (a NYSE-tradedpublic company), the lead independent director of LPL Financial Holdings Inc. (a NASDAQ-tradedpublic company), and a member of the advisory board of Grosvenor Capital Management Holdings, LLP (a private company), among others. SKILLS AND QUALIFICATIONS Mr. Thorpe is qualified to serve as a director due to his extensive knowledge of the healthcare industry as well as financial and corporate governance experience gained through years of serving as a director of multiple Hellman & Friedman LLC portfolio companies. |

| |

Corporate Governance and Board Matters

| | | | | |

| |

Dale A. White

Chief Executive Officer,Chairman, MultiPlan Corporation | Age: 6768

Committees: None |

| |

| |

BIOGRAPHY Dale A. White has served as President and Chiefour Executive Officer of MultiPlanChair since March 2024 and as a member of our Board since February 2022, overseeing and executing on the Company’s mission of delivering fairness, efficiency, and affordability2022. Prior to transitioning to the U.S. healthcare system.Executive Chair role, he served as our President and Chief Executive Officer from February 2022 to March 2024. Prior to that, Mr. White served as our President and Chief Operating Officer from August 2021 through February 2022, and in other senior roles at MultiPlan and its predecessors since 2004. Before joining MultiPlan in 2004, Mr. White had previously co-started two healthcare companies and held senior leadership positions at several healthcare organizations, including BCE Emergis, where he served as SVP of Sales and Marketing. Mr. White currently serves on the board of Abacus Insights, Inc., in which the Company holds a minority interest. He also serves on the board of AAPAN, a non-profit trade organization, as well as ConvenientMD, a private corporation specializing in urgent care medical services. SKILLS AND QUALIFICATIONS Mr. White is qualified to serve as a director due to his extensive knowledge of the healthcare industry, as well as his experience in various senior executive roles at MultiPlan including as our current Executive Chairman and our former Chief Executive Officer. |

| |

Each director nominee has agreed to be named in this proxy statement and to serve if elected. We have no reason to believe that any of the nominees will be unable to serve. However, if, before the election, one or more of the nominees should become unable to serve or for good cause will not serve, proxies will be voted for the remaining nominees and for any substitute nominees to be selected by the Nominating and Corporate Governance Committee and approved by the Board.

Continuing Class I Directors

| | | | | |

| |

Michael K. AttalINDEPENDENT

Principal, Hellman & Friedman LLC

| Age: 31

Committees: Audit (Observer) and Risk

|

| |

| |

BIOGRAPHY

Michael K. Attal has served as a member of our Board since August 2022. Mr. Attal has served as a Principal at Hellman & Friedman LLC since November 2019. He is active in the firm’s investment in Medline, a global manufacturer, distributor, and solutions provider focused on improving the overall operating performance of healthcare. He was also formerly active in the firm’s investment in PPD, Inc. (a NASDAQ-traded company before it was acquired by Thermo Fisher in 2021). Prior to joining Hellman & Friedman LLC in 2016, Mr. Attal worked as an investment banker in the mergers and acquisitions department of Morgan Stanley & Co.

SKILLS AND QUALIFICATIONS

Mr. Attal is qualified to serve as a director due to his financial acumen, experience in the healthcare industry, experience with environmental, social, and governance matters, and mergers and acquisition experience.

|

| |

Corporate Governance and Board Matters

| | | | | |

| |

C. Martin HarrisINDEPENDENT

AVP of the Health Enterprise and Chief Business Officer, Dell Medical School at The University of Texas at Austin

| Age: 66

Committees: Risk

|

| |

| |

BIOGRAPHY